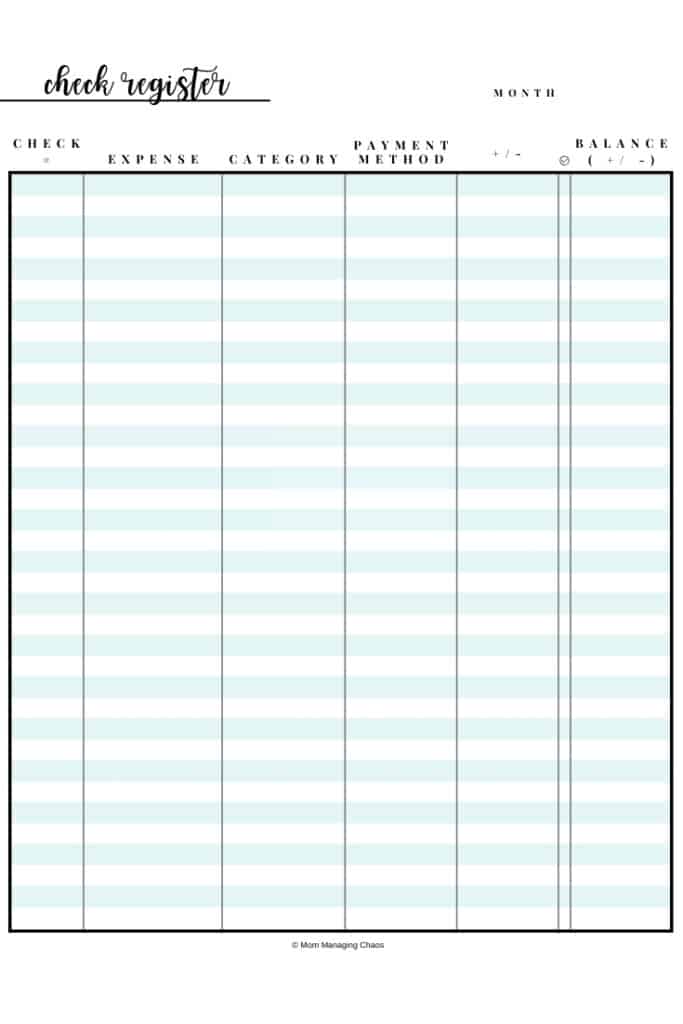

I want to help you!įor more information about invoice factoring call (800) 833-3765, extension 150 or use our online factoring application. Knowing how to balance a checkbook can help you uncover potential errors or incorrect charges in your bank account. While old school balancing a checkbook or keeping a physical ledger is essential for proper money management. It is kept in the bank of the checkbook and was easy to just write the total down in the checkbook register and add it up. Along the way, if you have any suggestions on how I can help shed more light on the complicated topic of cash flow management, please email me at. A checkbook register is an easy way to check your transaction history and remaining balance. I encourage you to review the article above, and hope that you will find it helpful. Best of luck! Have any more questions about cash flow management? Need more information about how to maintain your balance? Here is a detailed article on balancing a checkbook to help you get a handle on this cash flow management challenge. Getting started again is the hard part, but once you get your account balanced it is easy to maintain. However, the key is to get to a starting balance that you know is correct, and then start to track and balance your transactions every month. Opening a new account is by far the easiest way to get a fresh start if you do not have a lot of experience in working with checkbooks. When balancing a checkbook that has not been balanced in a while (if ever!), what is the best choice? You can try using a Checkbook App on your Smartphone to keep track of your spendings, such as Checkbook by Digital Life Solutions or ClearCheckbook by SiliconTrance. Note: This can take up to a couple of weeks, so it may not be a viable option for you. Of course, if you suspend using your account for a couple of weeks and get a new balance, there still is a chance that old transactions or checks from previous months may clear and, if that is the case, you will have to include them with your new transactions to balance. This is not a perfect solution, but it can be a way to start fresh going forward. You would stop using your account prior to the end of the month, so that when your new bank statement comes, the balance on the statement becomes your new starting point. This method involves suspending the use of your account for a week or so until all of the pending checks, deposits and other transactions clear your account. This is another option if you cannot easily open a new account or can’t find all of your old account statements.

Banks CAN make mistakes, but even more likely is that youll make a math. Again, I would be careful going back too many months regardless of whether or not you have your statements because, while it can be done, it will be a tedious task to complete. Balancing your checkbook verifies that your records match the banks records. You would merely go back to your initial bank statement and work forward. If you have a relatively new account – say less than six months old – and you have access to your previous bank statements, then this is an option.

0 kommentar(er)

0 kommentar(er)